Trading With Candlesticks Pdf

(PDF) THE CANDLESTICK TRADING BIBLE 2 THE CANDLESTICK TRADING. View TheCandlestickTradingBible.pdf from BUSI 1301 at Collin College. THE CANDLESTICK TRADING BIBLE 1 THE CANDLESTICK TRADING BIBLE Content Introduction 4 Overview 6 History of. How to make money trading with candlestick charts pdf - Books Type PDF How To Make Money Trading With Charts Edition with a New. When you learn how to read a candlestick chart and start using this simple., (PDF) Mastering Mastering Candlestick Candlestick Charts 1 Charts 1 inka arifin - rumahhijabaqila.com. Profitable Candlestick Trading - Stephen W.

- Trading With Candlesticks Balkrishna Pdf Download

- Trading With Candlesticks Pdf

- Trading With Candlesticks Pdf

How To Make Money Trading With charts Pdf Free Download

To browse Academia. Skip to main content. You're using an out-of-date version of Internet Explorer. By using our site, you agree to our collection of information through the use of cookies. To learn more, view our Privacy Policy. Log In Sign Up.

Candlestick charts: The ULTIMATE beginners guide to reading a candlestick chart

Gold was the first metal to consider for mining since prehistoric times. People attracted to this metal because of its absorption of some […]. Forex market is something that attracts people to come and trade and earn money. And should have a proper strategy before entering the forex market. Strategies plan are something that defines your path of doing something.

Slideshare uses cookies to improve functionality and performance, and to provide you with relevant advertising. If you continue browsing the site, you agree to the use of cookies on this website. See our User Agreement and Privacy Policy. See our Privacy Policy and User Agreement for details. Published on Sep 15,

Goodreads helps you keep track of books you want to read. Want to Read saving…. Want to Read Currently Reading Read. Other editions. Enlarge cover.

Part I: Getting Familiar with Candlestick Charting and Technical Analysis Only a Full-time Professional Can Make Money in the Markets Technical.

pressure vessel design pdf free download

See a Problem?

This book explains step-by-step how you can make money by trading the powerful and proven candlestick techniques. Here is how:., To browse Academia. Skip to main content.

.

Logical and analytical reasoning booksnovel

Each merchant needs to exchange Candlestick pattern PDF with benefit. To get the benefit they utilized various markers and those pointers help them to think about value patterns, quality, and numerous different things. Today, I will educate you regarding the candle inversion design pointer that what is candle inversion design marker and how it causes you to get benefit in your exchange?

To comprehend candle pointer you need to require significant investment and gain proficiency with all the candles designs in the marker. candlestick pattern indicator is a pointer that informs you regarding what’s going on in the candle outline whether the cost is close to excessively high or it is going close to low.

How to Read Candlestick Charts PDF?

This marker likewise causes you to know how the candles change when the cost is slanting high or low. In the wake of utilizing such a large number of candle pointers, we came to convey that this marker is the best pointer that tells about candle conduct.

In a week after a week, this pointer just shows two inversion designs. One is Bullish sledge and the subsequent one is Bearish overwhelming.

Forex Candlestick Chart Patterns PDF

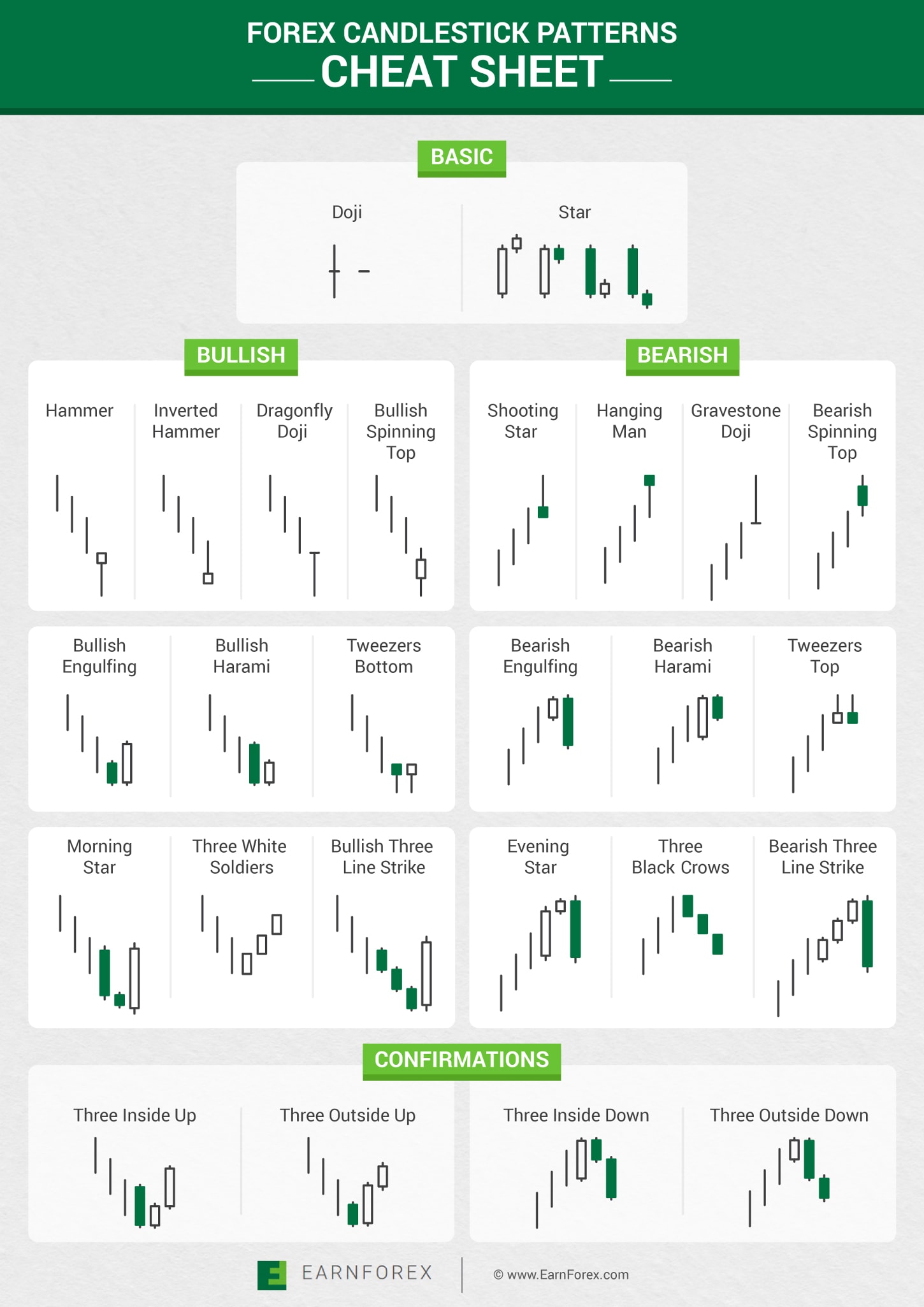

This candle pointer has bullish and bearish examples. The bullish example shows the upturn of candle designs and the bearish example demonstrates the downtrend of candle design. There are 18 standpoints for the bearish and bullish example in the pointer which are given beneath:

/download-boondocks-season-4-free.html. 1. Bullish Hammer:

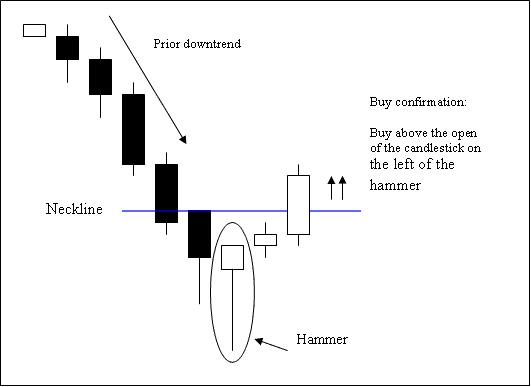

A hammer is a candlestick pattern that plots on the indicator chart when the security trades are low than openings. This pattern draws hammer-shaped candlestick pattern in which shadows are at least twice the real size of the pattern body. Hammer has a small body, it occurs when the price is dead.

2. Morning star:

It is a visual pattern that has three candlesticks. It follows a downtrend and it indicates the startup of an upward climb. It is a sign of a reversal candlestick pattern. It is made up of tall black candlesticks that have short bodies and long wicks. One of the morning stars captures the moment of the market.

3. Bullish engulfing pattern:

This candlestick has two reversal candles. The second candlestick pattern engulfs the body of the first candlestick. It appears in a downtrend pattern. It helps to make reliable trade. It forms a pattern when the small candle is followed by the large one.

4. Piercing line pattern

It is a two-day trading pattern. It forms short term reversal price patterns. It can be used for only five days. It detects the downtrend, gap and strong reversal pattern. It works with only short term traders. It helps to trade better. It can detect the gap of overnight.

Bullish Candlestick Patterns PDF

5. Morning doji star

It is a bullish candlestick pattern. This pattern is similar to the morning star pattern. It also consist of a long bearish candle, it has characteristics to gap down between different candlesticks. It consists of three bodies, the first stick has long black bod, the second bar opens it open near the lower point and the last one is for the final midpoint of the candlestick pattern.

Trading With Candlesticks Balkrishna Pdf Download

6. Shooting star

It is a type of candlestick pattern which opens when the security opens in the market trend. It is a bearish trend because price rises many times during a day but the sellers push the price back at its original place.

7. Evening star

It is a stock price candlestick pattern.it is used for technical analysis when the trend is going for a reversal pattern. It also contains three bodies, a large body, a small body, and a red body candle. It is related to up trend and downtrend in the market trend. It is used to detect future price lines. This pattern is also a reliable technical trend pattern. This star is opposite to morning star. One of them is bullish and the other one is bearish.

Candlestick Reversal Patterns PDF for Beginners

8. Bearish engulfing star

The bearish engulfing pattern is used to detect the lower range in the price movement. This pattern has white, green, black, and red candlesticks. It is an important pattern because it tells the overbought and oversold range in the market trend. This pattern can be created anywhere in the market trend.

9. Evening doji star

This pattern consists of a bullish trend. It has a long bullish candlestick. The first two candles act as bearish candlesticks. This pattern is similar to the evening star pattern. It creates a gap between the candlestick bodies.

10. Dark cloud pattern

It is a bearish reversal pattern used to show changings in the momentum of the market trend. This indicator is made up of one bearish candle and one bullish candlestick that close above the midpoint. It shows the declining prices and confirmation of declining of the price.

On the off chance that you are exchanging with this pointer, at that point, you have an excessive number of opportunities to pick up the benefit yet to get the benefit you have to comprehend this marker and need to concentrate on the candles and conduct of candles.

How to Understanding Candlestick charts PDF

Trading With Candlesticks Pdf

This indicator has numerous utilizations some of them are referenced here. It filters the outline naturally, it doesn’t make a difference which period is chosen on the diagram. It shows the specific example of whether the candle’s arrangement is as a Night star, Morning star, meteorite, Bearish overwhelming, or Bullish immersing day trading chart patterns pdf.

Technical Analysis Chart Patterns PDF

Trading With Candlesticks Pdf

The candle examples can without much of a stretch be clarified by the client as it shows a candle design of the left half of the pointer graph. It has one increasingly explicit utilizations that show a truncated example on the diagram. On the off chance that the shortened example is over the candles, at that point,

the outline shows a bearish example and on the off chance that the contracted example is underneath the candle, at that point it demonstrates a bullish example.

It doesn’t make a difference where period you are exchanging, this pointer gives you light inversion design in whenever outline on your graph. You can utilize a bullish inversion candle design just when the cost is an upturn. You can utilize a bearish inversion candle designs just when the cost is in a downtrend. You can utilize doji and immersing examples to see the turning around the pattern of the pointer.